Equity Pledge Debt Fund 856

Type: Debt

Target: $20,000,000

Annual Return: 8.15% - 8.40%

Min-invest Amount: $10,000

Duration: 6 – 36 Months

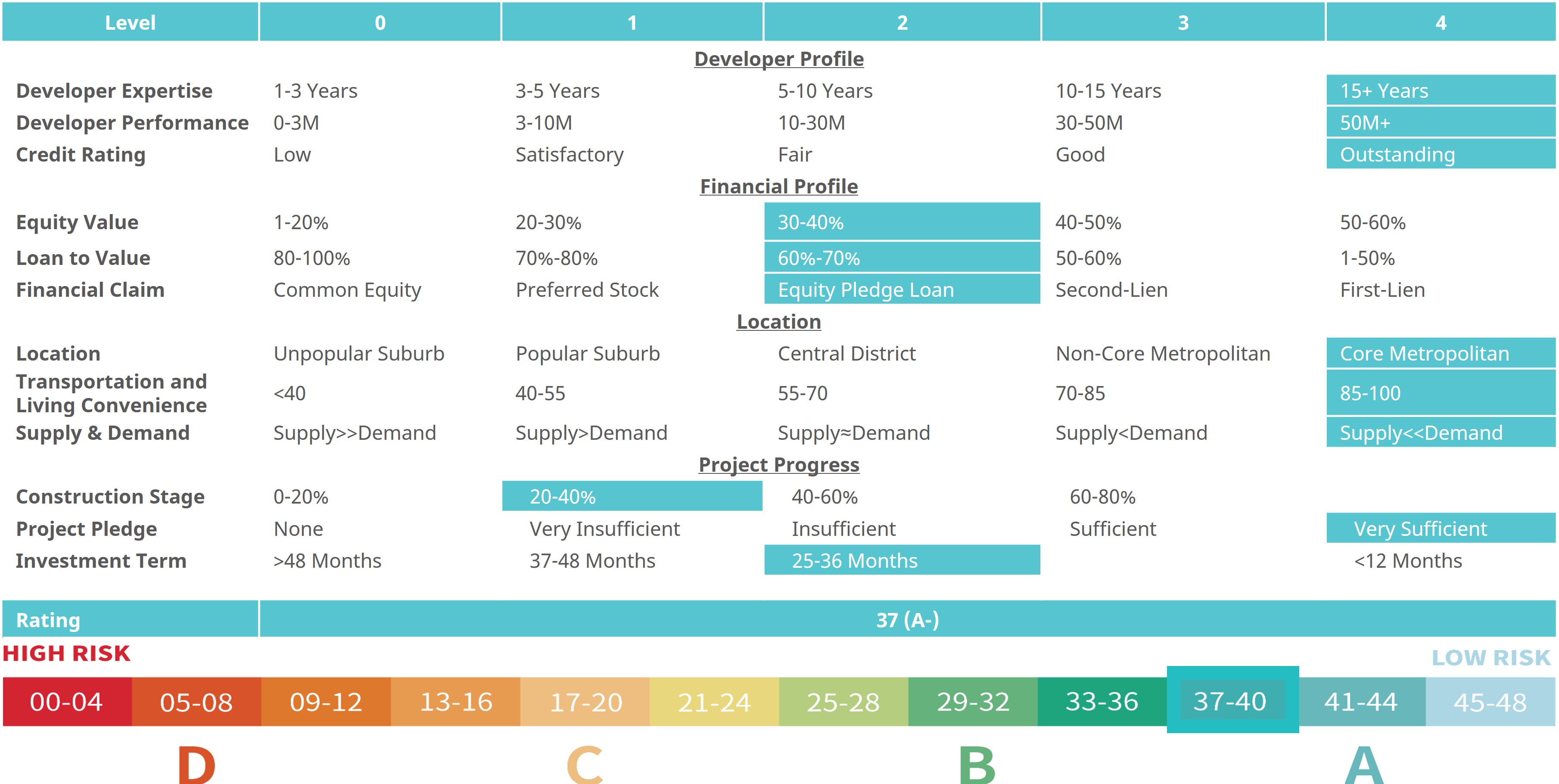

| Fund Type | Private Equity Fund |

| Offering Amount | $20,000,000 |

| Estimated Return | 8.15 – 8.40% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | June 2025 |

| Investment Timeline | 6 – 36 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.15% Annualized Return for Investment of 1-19 Units; 8.40% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 5 extension options, and investors will receive dividends accordingly at the same dividend rate.

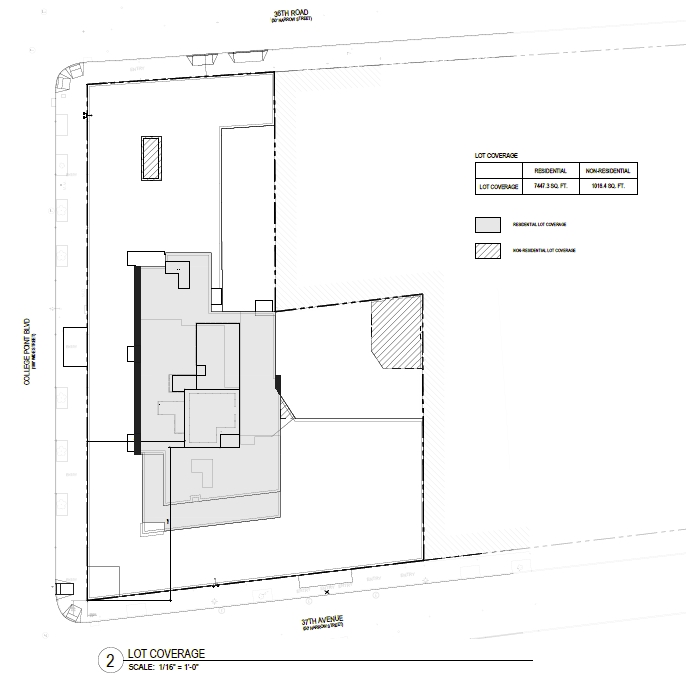

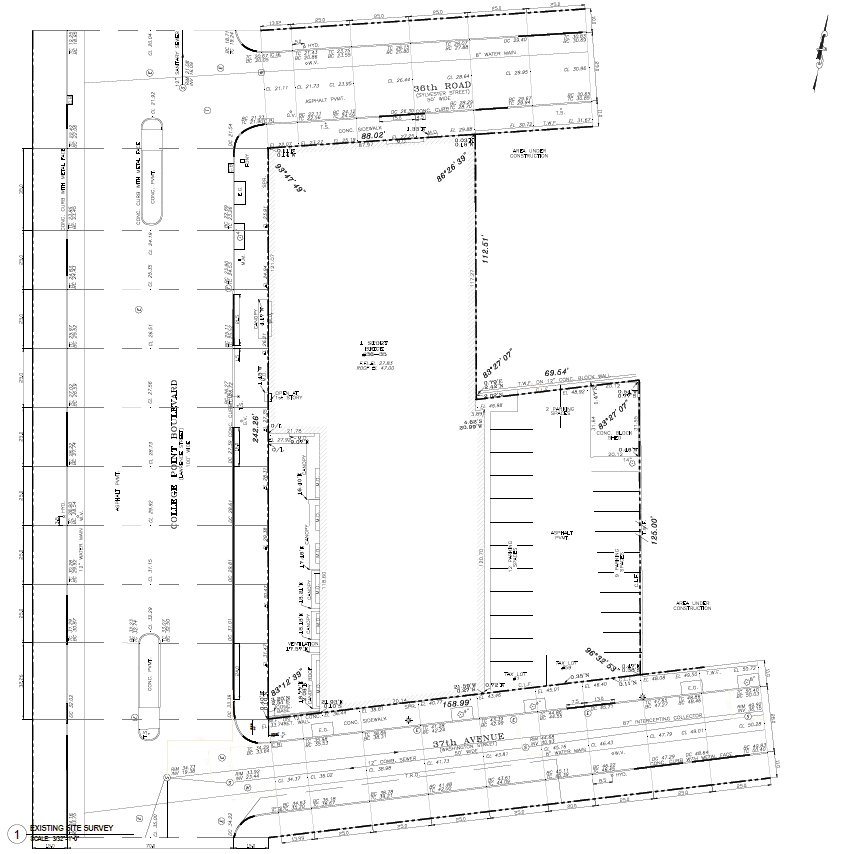

- The subject property is in the heart of Flushing, Queens, on the east side of College Point Boulevard between 36th and 37th Streets. It faces Citi Field and the future Metropolitan Park development, which will include a casino, amusement center, restaurants, and entertainment venues. The site is two blocks east of Main Street and two blocks north of Roosevelt Avenue, with the Metro Line 7 and LIRR station within a 10-minute walking.

- The project land was acquired in November 2022, and the construction had begun in late 2024. The planned development is a 15-story mixed-use building featuring 99 condominium units, 81,361 sqft. of retail space, and 311 basement parking lots. The demolition and foundation works are nearly complete, with project completion expected by September 2027. Planned amenities include a fitness center, yoga room, laundry room, pet wash station, residents’ lounge, game room, storage units, bike room, and two landscaped courtyards. Currently, 60% of the retail space has been pre-leased to prospective tenants.

| Address | 36-27 College Point Boulevard, Flushing, Queens, NY 11220 |

| Area | Flushing, Queens, New York |

| Lot Area | 29,829 Sqft |

| Building Area | 173,099 Sqft |

| Intended Use | 99 Condo Units, 81,361 Sqft of Retail Space, and 311 Parking Lots. |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Investment Phase*1 | Funding Amount | Dividend Date*2 | Counting Date | Ending Date | Dividend Period | Note |

| First | First | $2,000,000 | No Later Than 7/9/2025 | 6/25/2025 | 12/24/2025 | 183 days | Prepaid Dividend*3 |

| Second | $2,000,000 | No Later Than 8/9/2025 | 7/25/2025 | 12/24/2025 | 153 days | Prepaid Dividend | |

| Third | $2,000,000 | No Later Than 9/9/2025 | 8/25/2025 | 12/24/2025 | 122 days | Prepaid Dividend | |

| Fourth | $2,000,000 | No Later Than 10/9/2025 | 9/25/2025 | 12/24/2025 | 91 days | Prepaid Dividend | |

| Fifth | $2,000,000 | No Later Than 11/9/2025 | 10/25/2025 | 12/24/2025 | 61 days | Prepaid Dividend | |

| Sixth | $2,000,000 | No Later Than 12/9/2025 | 11/25/2025 | 12/24/2025 | 30 days | Prepaid Dividend | |

| Second | Seventh | $2,000,000 | No Later Than 1/9/2026 | 12/25/2025 | 6/24/2026 | 182 days | Extension Option Owned by Borrower*4 |

| Eighth | $2,000,000 | No Later Than 2/9/2026 | 1/25/2026 | 6/24/2026 | 151 days | Extension Option Owned by Borrower | |

| Nineth | $2,000,000 | No Later Than 3/9/2026 | 2/25/2026 | 6/24/2026 | 120 days | Extension Option Owned by Borrower | |

| Tenth | $2,000,000 | No Later Than 4/9/2026 | 3/25/2026 | 6/24/2026 | 92 days | Extension Option Owned by Borrower | |

| Third | - | - | No Later Than 7/9/2026 | 6/25/2026 | 12/24/2026 | 183 days | Extension Option Owned by Borrower |

| Fourth | - | - | No Later Than 1/9/2027 | 12/25/2026 | 6/24/2027 | 182 days | Extension Option Owned by Borrower |

| Fifth | - | - | No Later Than 7/9/2027 | 6/25/2027 | 12/24/2027 | 183 days | Extension Option Owned by Borrower |

| Sixth | - | - | No Later Than 1/9/2028 | 12/25/2027 | 6/24/2028 | 183 days | Extension Option Owned by Borrower |

*1 Funding amount of different investment phases could vary based on construction progress.

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*1 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*1 After the first dividend period, Borrower owns 5 extension options, and investors will receive dividends accordingly at the same dividend rate.

- According to a third-party valuation report provided by CBRE, the land is valued at approximately $59,100,000, with estimated total development costs of $143,600,000 and a projected market value of $191,975,000 upon completion.

- Additionally, the key individual from the borrower will provide an unlimited personal guarantee. This guarantor has a reported net worth exceeding $140,000,000.

- The subject property is in the heart of Flushing, Queens, on the east side of College Point Boulevard between 36th and 37th Streets, directly across from Citi Field and the future Willets Point Metropolitan Park casino and entertainment complex. It is just two blocks from Main Street and Roosevelt Avenue, with the Metro Line 7 and LIRR station both within a 10-minute walking.

- Flushing has become the largest Chinese community on the U.S. East Coast, with growing demand for all property types driven by a surge in Asian residents. The area continues to show strong development potential, especially with upcoming projects like Metropolitan Park and the Flushing waterfront redevelopment drawing investor attention.

- The borrower plans to use the loan provided by Fund 856 entirely for construction and related soft costs during the development phase, ensuring the project stays on schedule and transitions to sales as soon as possible. The actual loan disbursement may be adjusted based on construction progress and funding needs.

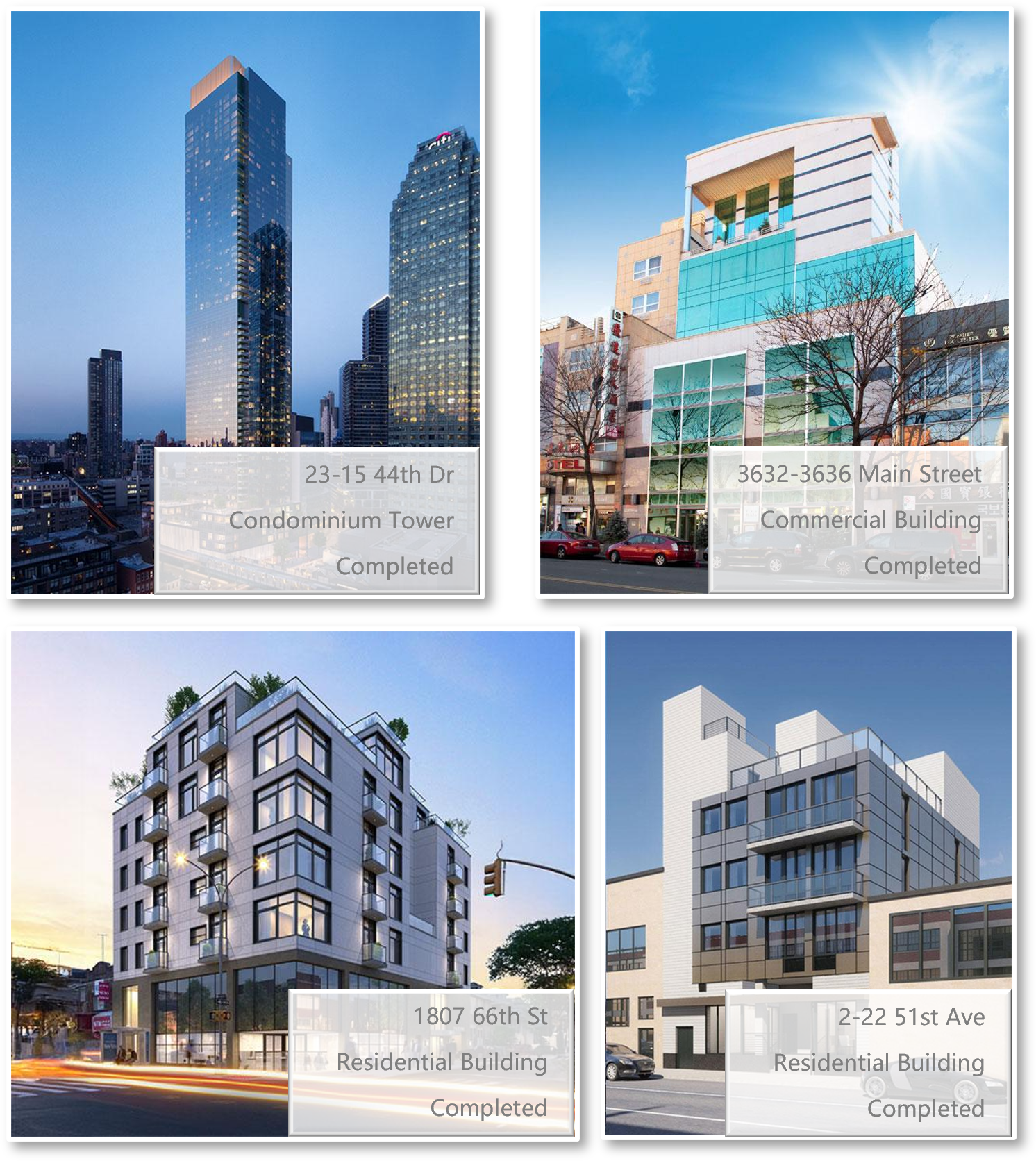

- The borrower for CrowdFunz Fund 856 is a family-run firm with deep roots in New York real estate market. Starting from a Queens-based title company, the firm capitalized on the Flushing development boom and has since built over 30 years of experience in both real estate development and investment.

- Past successful exits include a landmark residential project in Long Island City, mixed-use developments in Flushing, and residential properties in Brooklyn.

- Although this is the first collaboration between CrowdFunz and the borrower, the borrower has previously participated as a co-GP in several successful projects with developers who have worked with CrowdFunz. Both parties see this partnership as an opportunity to support the project's completion while delivering attractive investment potential to fund investors by tapping into local market growth.

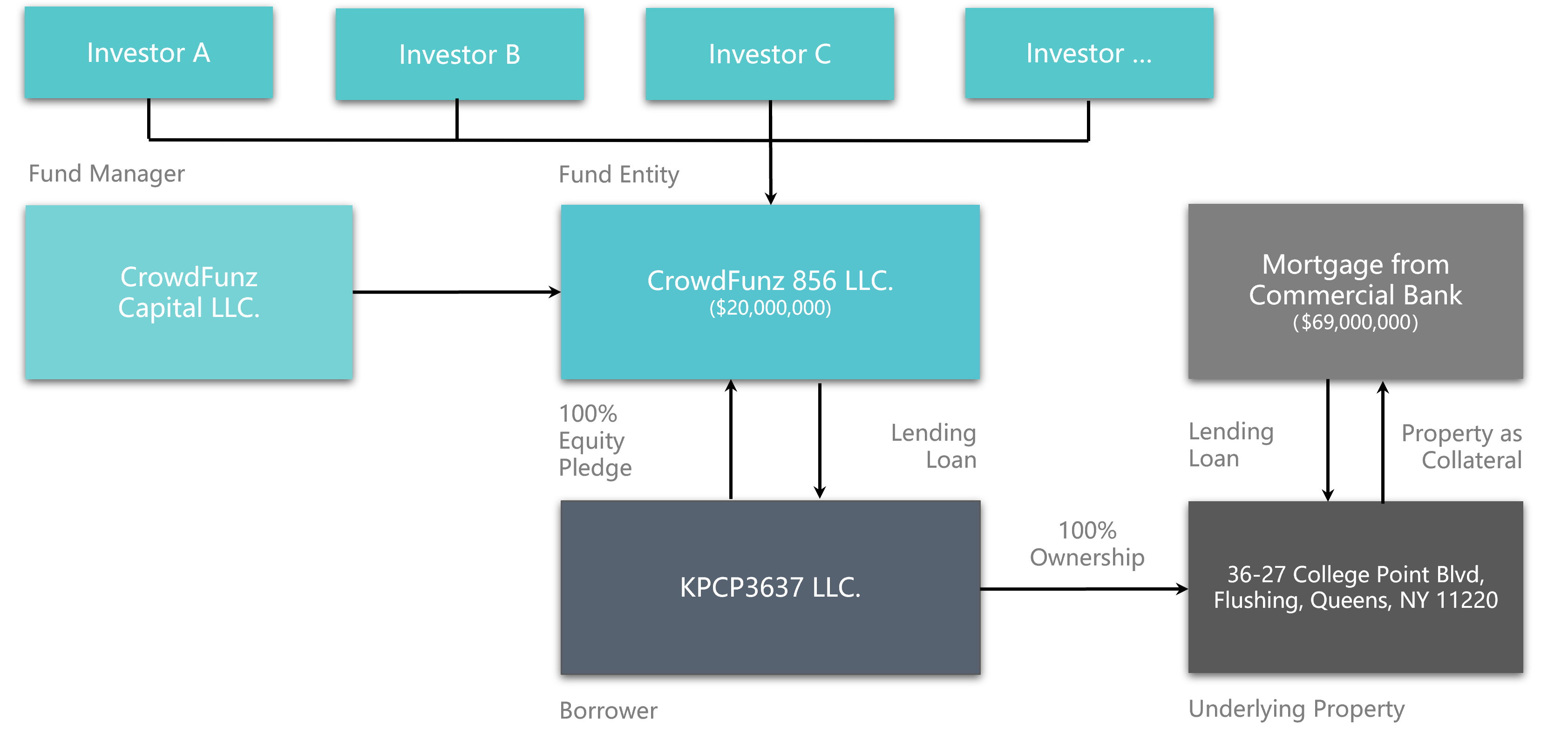

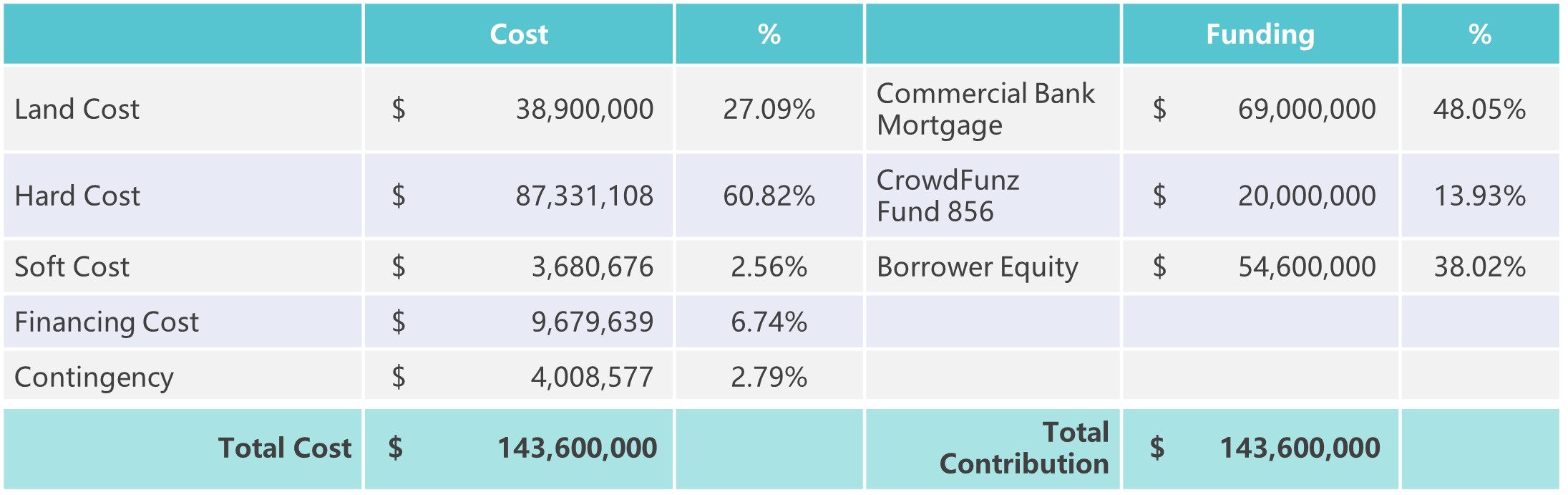

Capital Structure of CrowdFunz Fund 856

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Ponce Bank Mortgage | $69,000,000 | 48.05% | |

| CrowdFunz Fund 856 Equity Pledge Loan | $20,000,000 | 13.93% | |

| Equity value | $54,600,000 | 38.02% | |

| Valuation – Cost Basis | $143,600,000 | 100.00% | |

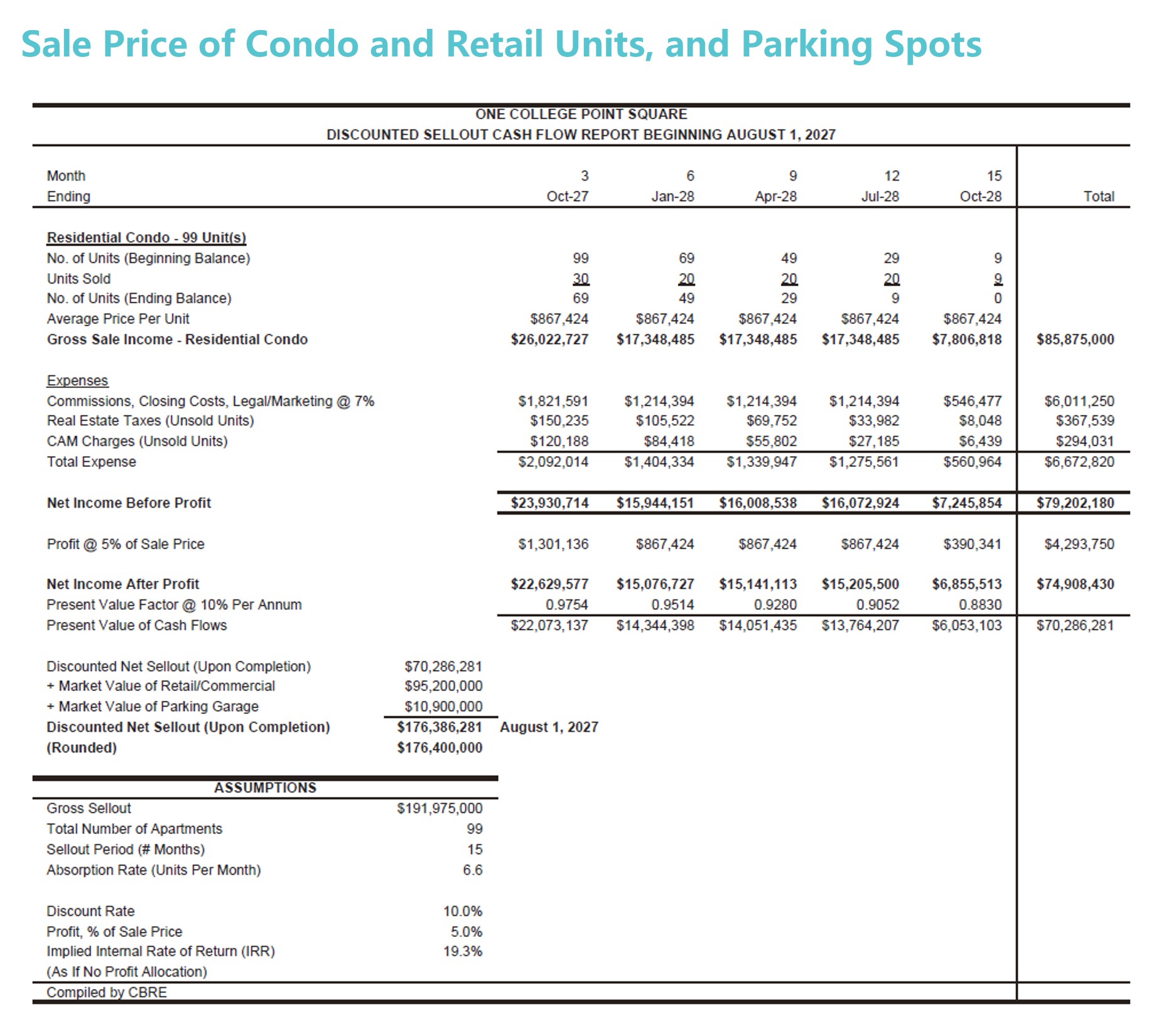

- According to the third-party valuation report by CBRE, the land is valued at approximately $59,100,000, with total projected development costs of $143,600,000 and a market value of $191,975,000 upon completion.

- The mid-term loan from Fund 856 will be issued in coordination with senior lender Ponce Bank, with a UCC1 filing and equity pledge of 100% ownership of the project company’s equity. The borrower is expected to contribute $54,600,000, which is 2.5 times the Fund 856 loan amount, representing 38.02% of the total capital stack. Ponce Bank will provide a $69,000,000 senior mortgage (48.05%), and Fund 856 will provide $20,000,000 (13.93%).

- Based on the current capital structure, the project’s loan-to-cost (LTC) ratio is 61.98%, slightly below typical industry levels, indicating conservative leverage.

- Additionally, the borrower’s key individual will sign an unlimited personal guarantee, with a personal net worth exceeding $140,000,000, ensuring full repayment of principal and interest. In case of default, Fund 856 has legal rights to pursue recovery through the guarantor’s personal assets.

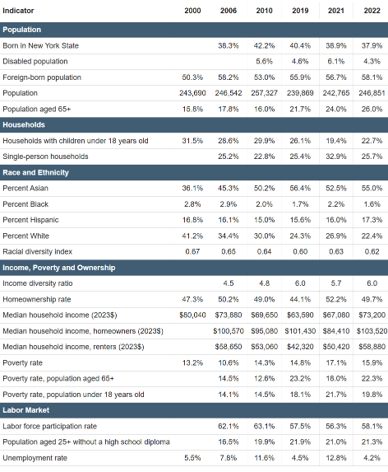

Demographics in Zip Code Area

| Flushing/Whitestone | |

|---|---|

| Population | 246,851 |

| Median Age | 47 |

| Born in | New York (37.90%)/ Out of the U.S (58.10%) |

| Race | Asian(55.00%) / Caucasian (22.40%) / Latino(17.30%) / African American(1.60%) |

| Median Family Income | $73,200 |

| Child-bearing (Under 18) | 22.70% |

| Unemployment Rate | 4.20% |

Flushing has been one of the fastest-growing neighborhoods in New York City over the past 20 years, driven by its convenient transit access and proximity to LaGuardia Airport, attracting many Asian immigrants.

The area is ethnically diverse, with Asians making up 55% of the population, followed by White (22%) and Hispanic (17%) residents. Most households are stable, working middle-aged families, with an average age of 47 and a low unemployment rate of 4%.

In the past decade, a surge in Asian residents has fueled strong rental demand. Limited housing supply and strong buyer interest have led to steady increases in local property prices.

* Source: NYU Furman Center, and U.S. Census Bureau, in June 2025.

Residential Market Trend in Flushing

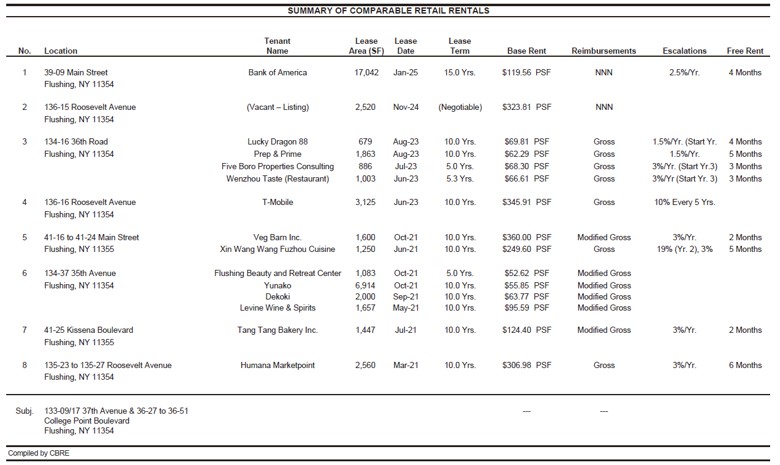

According to the CBRE valuation report, Flushing is currently the fourth-largest commercial center in New York City, following Midtown Manhattan, Downtown Manhattan, and Downtown Brooklyn. The intersection of Main Street and Roosevelt Avenue near the Metro station is the city’s third busiest pedestrian crossing—behind only Times Square and Herald Square.

Now recognized as the most dynamic Chinatown on the U.S. East Coast, Flushing has surpassed Manhattan’s Chinatown in scale and activity. Over the past 20 years, it has become a major hub for Asian immigrants, with continuous growth in new real estate developments and a thriving commercial district.

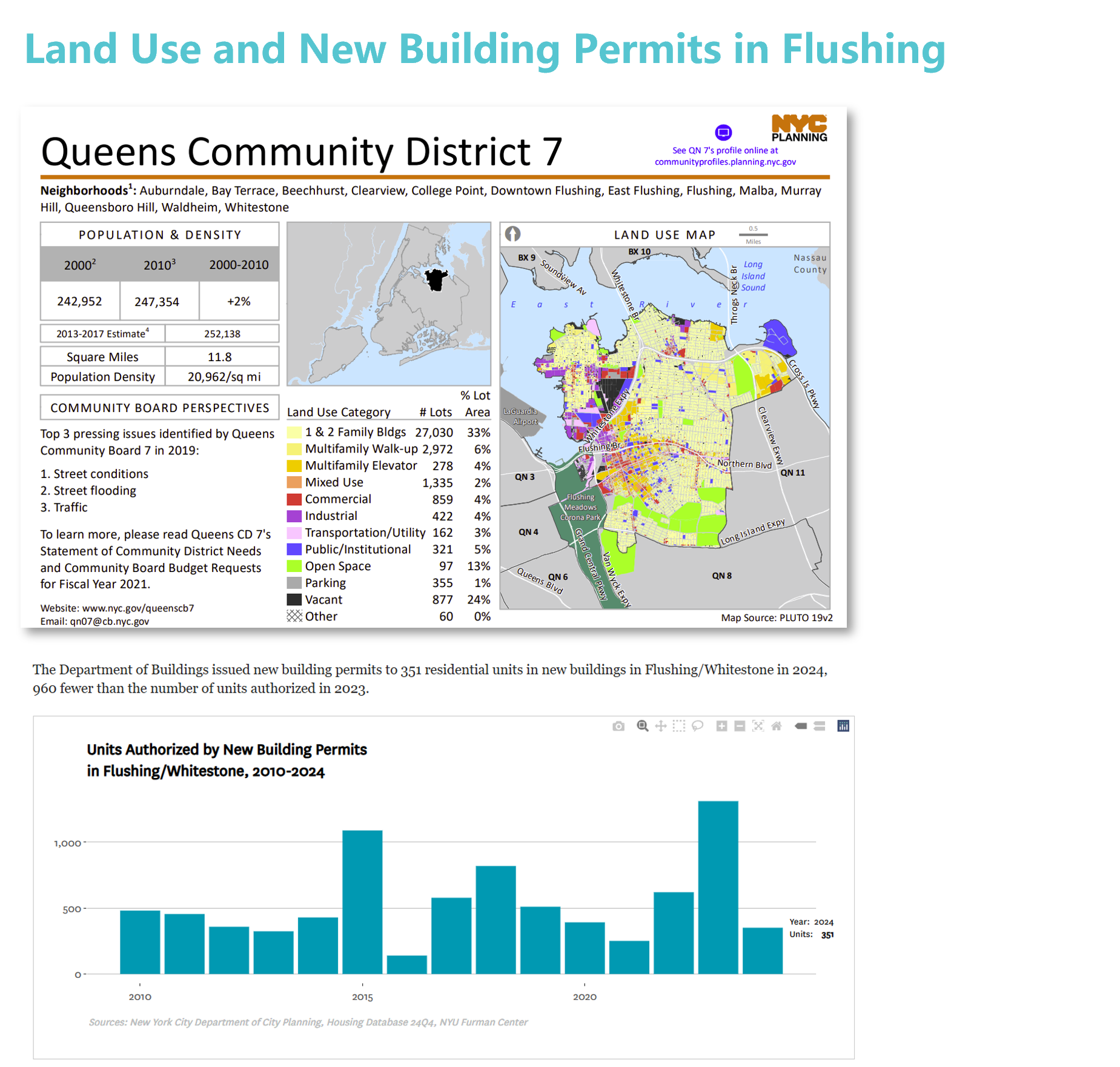

In Queens Community District 7, where Flushing is located, current land use is still dominated by 1–2 family homes (33%), with multifamily buildings making up about 10%, and both commercial and industrial uses each accounting for 4%.

According to NYU Furman Center data, Flushing experienced a residential construction boom in 2023, with 1,311 units approved. In 2024, new approvals declined to 351 units.

* From: NYC Planning, and NYU Furman Center, in June 2025.

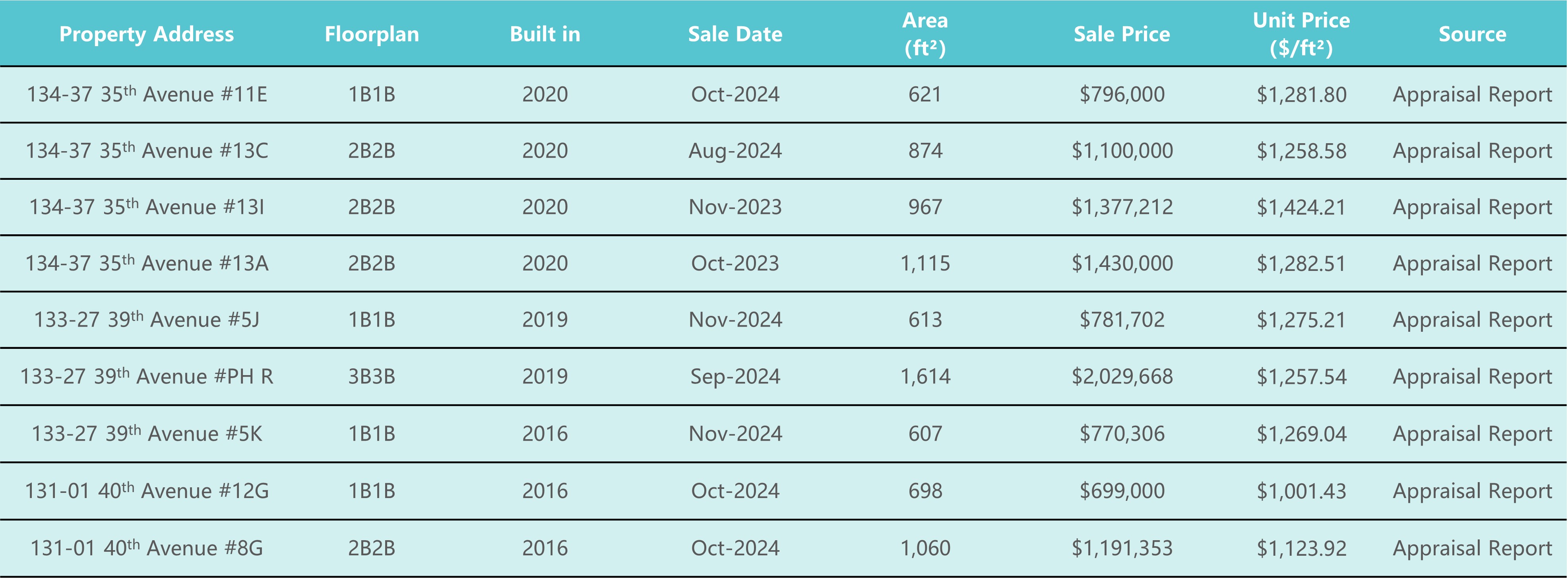

Residential Market in Flushing

According to data from the NYU Furman Center, by the end of 2023, home prices in the Flushing and Whitestone areas of New York City had increased by over 300% compared to 2000.

In 2024, the unit median sale price for single-family houses reached $990,000 with 467 units sold. For 2–4 family houses, the median was $588,750 with 312 units sold. Buildings with 5 or more units had a unit median price of $161,560, with 14 sales. Condominium units had a unit median price of $622,000, with 591 units sold during the year.

Rental data shows the median asking rent in Flushing and Whitestone rose from $1,760/month in 2006 to $1,910/month in 2023. The residential vacancy rate stood at just 3.3% in 2023—lower than the averages for both Queens and the broader New York City market.

* Source: NYU Furman Center, in June 2025.

Valuation Post-completion

According to the third-party valuation report by CBRE, the projected market value of the underlying project upon completion is approximately $191,975,000.

This includes an estimated $85,875,000 for the 99 condominium units, $95,200,000 for the commercial retail space, 60% of which has already secured pre-leased tenants, and $10,900,000 for the 311 basement parking lots. A detailed breakdown is shown in the chart to the right.

* Source: CBRE Appraisal Report.

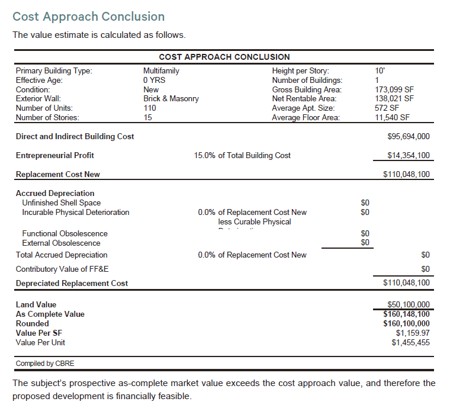

Cost Approach

According to the third-party valuation report by CBRE, the land value of the subject property is approximately $50,100,000, and the projected total development cost is $160,148,100.

Based on the developer’s submitted cost breakdown and actual land acquisition details, CrowdFunz considers a revised cost estimate of $143,600,000 to be more accurate. This figure aligns with the project’s current valuation and meets Fund 856’s underwriting standards. A detailed cost breakdown is shown in the chart below.

* Source: Cost data provided by developer and compiled by CrowdFunz.

Location

The property is well-connected with convenient transportation options. It is a 10-minute walking to both the 7-subway line and the LIRR station, with a 30-minute train riding to Midtown Manhattan. LaGuardia Airport is just a 5-minute driving away, and JFK International Airport is reachable in 30 minutes driving. Several major bus routes also stop within a 10-minute walking radius.

Transportation

- Subway: 7-train (10-min walking)

- To Midtown: 30-minute train

- To JFK: 30-minute driving

- To LGA: 5-minute driving

School

The project is in central Flushing, an area well-equipped with educational resources. Numerous elementary, middle, and high schools are situated nearby, meeting a wide range of educational needs. The neighborhood also features a variety of language and early childhood education centers, supporting well-rounded development for children.

Living Facilities

The property is close to a well-established Chinese commercial district, offering excellent convenience. The area features a wide range of Chinese and Korean supermarkets, diverse dining options, and large shopping centers—meeting residents’ daily living and grocery needs.

Entertainment

The project is surrounded by a variety of museums, sports venues, and entertainment facilities. Nearby Corona Park is a major cultural landmark in the area. Other nearby attractions include the New York Hall of Science, New York Badminton Center, USTA National Tennis Center, Queens Museum of Art, Queens Zoo, and Citi Field.

Developer Company: FSA Capital.

Website: https://fsacapital.com/

Developer Website: https://www.1collegepointsquare.com/

- CrowdFunz Fund 856, in coordination with a senior mortgage lender, provides a mid-term construction loan to the borrower. The loan will be used to cover construction and soft costs during the development phase, helping ensure the project is completed on schedule. Repayment is expected through condominium sales, cash flow from other real estate assets, or refinancing proceeds.

- The project has a loan-to-cost (LTC) ratio of 61.98%, below typical industry levels, indicating manageable leverage. The borrower is expected to contribute $54,600,000, more than 2.5 times the loan amount, demonstrating strong equity support.

- The property is located at a prime area of Flushing, Queens. The planned Willets Point casino and entertainment complex, along with future waterfront redevelopment, will bring added growth opportunities to the area.

- Given the conservative structure and strong market fundamentals, CrowdFunz Fund 856 is considered a low-risk, fixed-income investment opportunity.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)